Does A Tracfone Have Service All Over The United Staes

Verizon'due south TracFone Conquering: What it Could Mean for the Wireless Manufacture

Verizon Communications appear on Monday that it would buy América Móvil's wireless service TracFone in a $6.25 billion cash and stock bargain. Verizon says it expects this deal to be completed in the 2d half of 2021.

The bargain volition be separate into $3.125 billion cash and $3.125 billion Verizon common stock. In addition, following the closing of the deal, Verizon shall pay to América Móvil:

- Up to $500 million as an earn-out if TracFone continues to achieve certain performance measures during the 24 months post-obit the endmost, calculated and paid in 4 consecutive 6-month periods

- 150 million deferred commercial consideration payable within two years following the closing

What information technology could hateful:

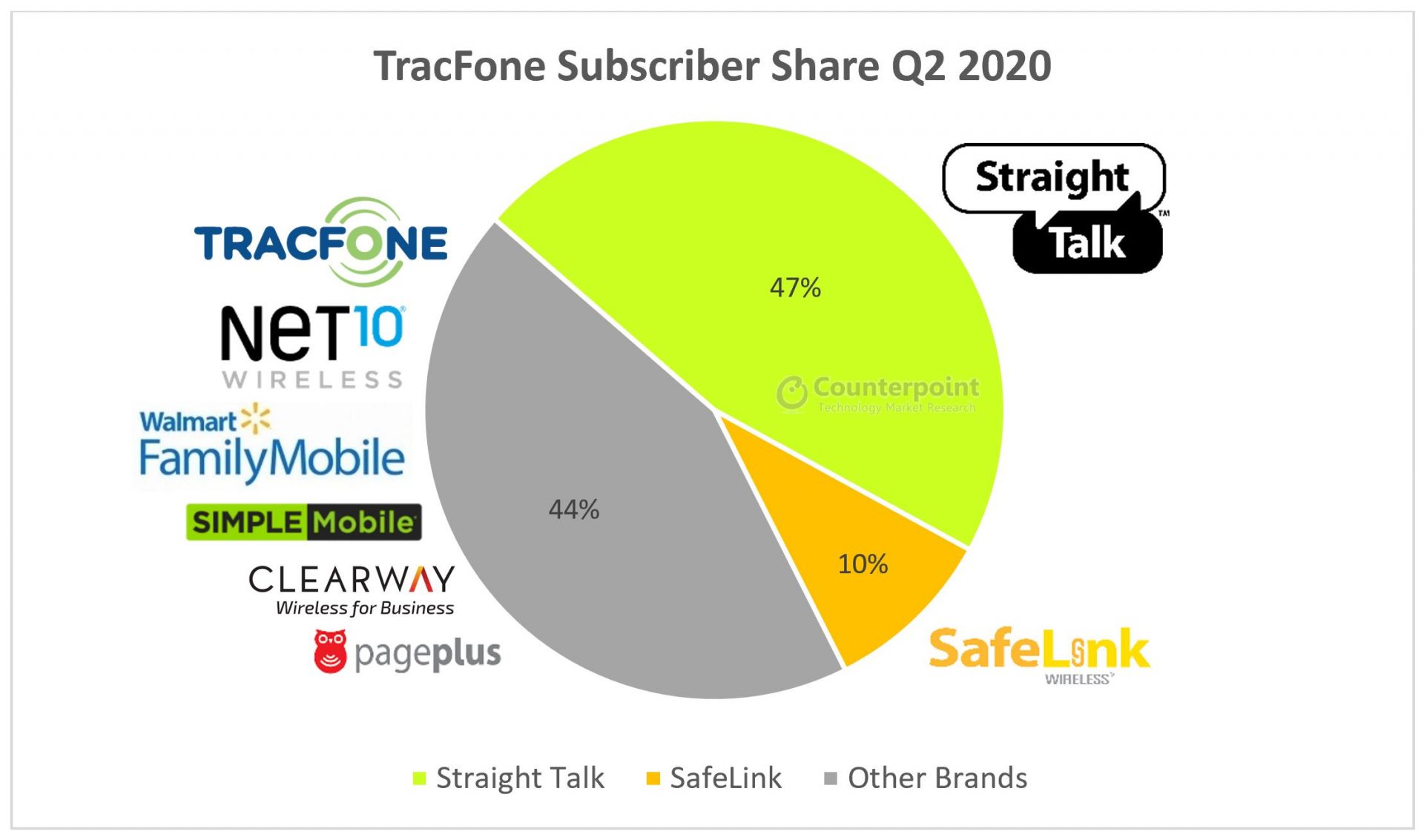

- Even more consolidation: If approved, this will further consolidate the manufacture and catapult Verizon to the largest prepaid service operator in the US. Verizon had four million prepaid connections in Q2 2020 and TracFone would add 21 one thousand thousand subscribers.

- Retail expansion: Verizon would proceeds share in national retail channels, particularly in Walmart via the Direct Talk brand. TracFone has had success in retail channels such as Walmart, Target, BestBuy, and even offers a limited SKU of devices and SIM cards in stores such as Kroger's and Dollar General. TracFone is nowadays in over 90,000 retail locations nationwide.

- Network availability: It is unclear if Verizon would switch the new TracFone network over to exist 100% Verizon based. There are thirteen 1000000 TracFone customers who use the Verizon network. This means 8 1000000 customers would accept to transition to the Verizon network and utilise a Verizon uniform device. TracFone has historically had agreements with four major carriers to run its network (Verizon, AT&T, T-Mobile, and Sprint). This created unlike device SKUs depending on the area subscribers live in and the coverage that was available.

- OEM opportunities: Verizon is expanding into the value segment with this bargain. Verizon's stealth MVNO Visible has ranged devices from the struggling ZTE and newcomer Hot Pepper and Verizon Prepaid'due south lineup includes devices from Nokia and Wiko. These OEMs could do good from the acquisition past potentially having more of their devices featured in TracFone and its sub-brands.

- 5G push: Lastly, this move will push Verizon's 5G ambitions forward, especially when information technology begins its sub-half-dozen GHz 5G service via dynamic spectrum sharing in 2021. However, 5G volition merely be truly accessible to a large swath of the U.s.a. population once 5G devices get below the $200 price point. For TracFone subscribers, the platonic sweet spot would be below $100.

While the deal was just appear, a lot of regulatory hurdles still need to be overcome earlier it gets approved. With the T-Mobile-Sprint merger, we have seen already how long large mergers and acquisitions tin can accept in the telecom sector. The FCC volition need to be convinced that this motility will truly increase contest and better the wireless industry as a whole. More to come here and we will continue updating on this as it develops.

Does A Tracfone Have Service All Over The United Staes,

Source: https://www.counterpointresearch.com/verizons-tracfone-acquisition/

Posted by: crusedowasobod.blogspot.com

0 Response to "Does A Tracfone Have Service All Over The United Staes"

Post a Comment